Uk

I work with the dead — here’s what happens at a funeral home late at night

UK funeral director shares eerie work encounters on TikTok, going viral with ghost stories.

Convicted Serial Rapist May Have Dozens More Victims Across Multiple Countries, Police Fear

Ph.D student convicted of raping women in UK and China; more victims feared

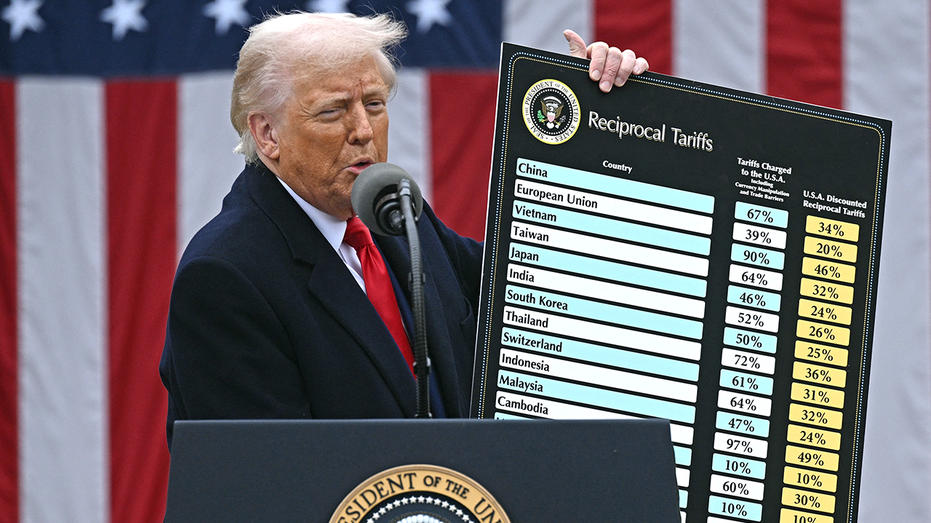

Some countries targeted by Trump tariffs seek negotiations, China says 'no winners in trade wars'

Trump's 'Liberation Day' tariffs spark global tensions, mixed reactions

UK and Mauritius close in on deal over Chagos Islands after US signals its consent

UK to transfer Chagos Islands sovereignty to Mauritius, leasing back military base

Despite clouds, some see partial eclipse in parts of Europe

Europeans gather to witness partial solar eclipse despite cloudy skies.

Sky Launches New Gen 2 Sky Glass TVs, With Cheaper Sky Glass Air Series To Follow

Sky unveils Gen 2 Glass TV with enhanced features, introduces affordable Glass Air series.

Thousands in Ireland still without power after Storm Éowyn

Storm Éowyn leaves millions without power across Ireland, UK; aid from France, England underway

Hong Kong offers rewards for arrest of six activists abroad

HK police offer bounties for UK, Canada-based pro-democracy activists

Forexlive - Dec 17th, 2024

Forexlive - Dec 17th, 2024

Inflation data the focus in Europe before the Fed later today

Major currencies are mostly little changed with exception of the aussie and kiwi today. Both the antipodes are being pulled lower, breaking to fresh lows for the year. AUD/USD is down 0.4% to 0.6311 now upon a break of key technical support from the August low highlighted here. Meanwhile, NZD/USD is down 0.3% to 0.5735 to its lowest since November 2022 as it sticks to the firm break under 0.5800 since last week.That is at least making for some interesting moves before we get to the FOMC meeting later. In broader markets, equities are keeping more tentative while the selling in bonds is also taking a light breather. All eyes are on the Fed now and that's the main event that traders will be looking to respond to next.Coming up in European trading, there will be inflation data on the cards. The UK one will be the more heavily watched as it will come before the BOE policy decision tomorrow. But with headline and core annual inflation both expected to come in higher than the month prior, it should just reaffirm the BOE decision to pause this week.The OIS market is already pricing in ~93% odds of the BOE leaving the bank rate unchanged. So, any upside for the pound may be more limited. That being said, the odds of a February rate cut are closer to 50-50 right now. So, higher price pressures here could still lift the quid as traders tone that down.Headline annual inflation is estimated to come in at 2.6%, up from 2.3% previously. Meanwhile, core annual inflation is estimated to come in at 3.6%, up from 3.3% previously.As for the Eurozone inflation data, these are final figures for November. As such, the impact is likely to be more muted.0700 GMT - UK November CPI figures1000 GMT - Eurozone November final CPI figures1100 GMT - UK December CBI trends total orders1200 GMT - US MBA mortgage applications w.e. 13 DecemberThat's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there. This article was written by Justin Low at www.forexlive.com.

Showing 1 to 9 of 9 results